What is a Record of Title?

- Joe Dev

- Oct 9, 2025

- 3 min read

Updated: Oct 12, 2025

Buying a property in New Zealand can be exciting, but if you don’t understand what’s written on the property title, you could end up owning something very different from what you think.

Whether it’s a cross lease, a freehold, or interests registered on the title, these legal terms can have a major impact on your rights, responsibilities, and even your resale value.

At Dev Advisory, we help buyers uncover hidden risks before they purchase, because one overlooked line on the title could cost you thousands.

What Does “Property Title” Mean?

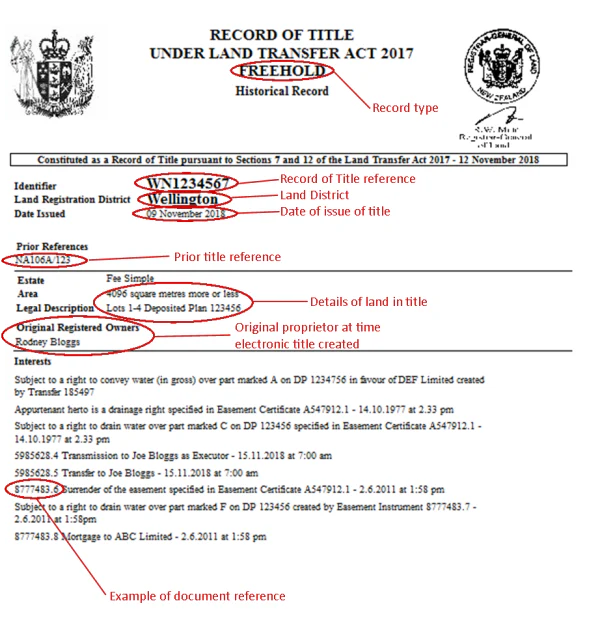

A property title (Certificate of Title) is the legal document that records:

Who owns the property

What type of ownership it has

What rights, easements, or restrictions apply to the land

When you buy property, you’re not just buying bricks and land, you’re buying the legal rights attached to it. That’s why understanding the title is a critical part of property due diligence.

Types of Property Titles in New Zealand

Before signing any agreement, it’s essential to know what type of title you’re buying. Each type affects your level of control, responsibilities, and resale potential.

1. Freehold

You own the land and buildings outright. You have maximum freedom (within council rules) to renovate, develop, or sell.

Pros: - Full ownership and control - Easier to finance and resell

Cons / Risks: - You’re responsible for all maintenance, rates, and compliance - May include easements or covenants that restrict use (e.g., shared driveways, design rules)

Freehold = full ownership (but still check for restrictions.)

2. Cross Lease

You share ownership of the land with others but lease back the area where your house sits.

Risks: - Need consent from co-owners to make changes (even painting or extensions) - Disputes can delay sales or renovations - Less desirable to banks and buyers → lower resale value

Cross lease = shared land, shared control, shared headaches.

3. Unit Title (Apartment or Townhouse Ownership)

You own your unit plus a share of common areas (hallways, lifts, gardens) through a Body Corporate.

Pros: - Shared maintenance - Access to facilities

Cons / Risks: - Ongoing Body Corporate fees - Limited say in property decisions - Disputes or poor management can reduce value

Unit title = convenience with conditions.

4. Leasehold

You own the building but lease the land from someone else (like a council or trust).

Pros: Lower purchase price

Cons / Risks: - Must pay ground rent (which can rise sharply) - Property value drops as the lease term shortens - Difficult to resell or mortgage

Leasehold = cheaper now, expensive later.

5. Company Share Title

You buy shares in a company that owns the building and land, giving you the right to occupy a specific unit.

Risks: - You don’t technically own the property. just shares - Harder to sell or finance - Major changes require company approval

Company share = collective ownership, limited control.

6. Stratum in Freehold (Hybrid)

You own your unit (stratum estate) and a share of the land beneath it.

Pros: Combines ownership with shared management

Cons: Still subject to Body Corporate rules and levies

Property Title : What to Watch

Even after understanding your title, interests registered on the title can create hidden problems.

These may include:

Easements (shared driveways or access rights)

Covenants (restrictions on materials, design, or use)

Encumbrances (legal burdens or obligations)

Mortgages or other financial claims

These can stop you from subdividing, building, or even parking where you want.

Buyers have discovered too late that a registered covenant prevents them from adding a second dwelling or minor unit. If you don’t check the title, you could be legally trapped.

Why Title Checks Are Critical in Property Due Diligence

Failing to review your title can lead to:

Costly legal disputes

Restrictions on renovation or development

Lower resale value

Problems securing finance or insurance

At DevAdvisory, we translate legal jargon into plain English, flag potential risks, and make sure you know exactly what you’re buying.

Don’t Take Chances!!! Get the Title Checked Before You Buy

A quick look at the property isn’t enough, you need to know what’s legally attached to it.

Before you sign, let our experts review your property’s:

- Title type (cross lease, freehold, unit title, etc.) - Registered interests and easements - Council and legal restrictions

Protect yourself from a legal headache or financial trap.